Joe Biden agreed to pay son Hunter’s legal fees for his deal with a Chinese government-controlled company, emails reveal.

The revelation ties the president even closer to Hunter’s overseas business dealings – and makes his previous claims that he never discussed them with his son, even less plausible.

Joe was able to pay the bills after earning millions of dollars through his and his wife’s companies after he left office as vice president.

Some of the wave of cash came from their book deals and speaking engagements.

But the president’s financial filings reveal that he declared almost $7million more income on his tax returns than he did on his government transparency reports, an analysis by DailyMail.com of the president’s financial records shows.

Some of that difference can be accounted for with salaries earned by First Lady Jill Biden and other sums not required on his reports – but still leaves $5.2million earned by Joe’s company and not listed on his transparency reports.

The ‘missing millions’ – combined with emails on Hunter’s abandoned laptop suggesting Joe would have a 10% share in Hunter’s blockbuster deal with the Chinese – raise a troubling question: did Joe Biden receive money from the foreign venture?

In January 2019, Hunter’s assistant Katie Dodge wrote an email to book-keeper Linda Shapero and Biden aide Richard Ruffner, saying Joe had agreed to pay his hundreds of thousands of dollars of bills.

The math behind Joe’s missing $5.2million

The president’s financial filings show that he declared almost $7million more income on his tax returns than he did on his government transparency reports, raising the question: where did the extra cash come from?

Joe Biden’s Office of Government Ethics (OGE) filings:

2017 – May 2019 filing:

Jill and Joe Biden income of $8,699,787

Income attributable to Joe Biden’s company CelticCapri Corp: $7,451,727

May 2019 – 2020 filing:

Income of $907,160

CelticCapri Corp income: $613,737

Total: $9,606,947, including $8,065,464 from CelticCapri

Joe Biden’s federal tax returns:

2017 Income of $11,031,309

CelticCapri Corp income: $9,636,690

2018 Income of $4,580,437

CelticCapri Corp income: $3,030,667

2019 Income of $985,233

CelticCapri Corp income: $578,178

Total: $16,596,979, including $13,245,535 from CelticCapri

Tax return versus OGE difference: $6,990,032

Unaccounted-for difference from CelticCapri: $5,180,071

‘I spoke with Hunter today regarding his bills. It is my understanding that Hunt’s dad will cover these bills in the short-term as Hunter transitions in his career,’ Dodge said.

The assistant attached a spreadsheet of bills with the email, totaling $737,130.61.

One of the last items was $28,000 in legal fees for the ‘restructuring’ of Hunter’s joint venture with the government-controlled Bank of China.

The spreadsheet listed the bill as ‘Faegre Baker Daniels: BHR Restructuring’ costing $28,382 and due ‘ASAP’.

BHR (‘Bohai Harvest RST’) is a private equity firm and one of Hunter’s two major Chinese business ventures. The joint venture was co-owned by the state-controlled Bank of China.

Hunter’s personal attorney, George Mesires, is a partner at Faegre Baker Daniels, now called Faegre Drinker.

A separate October 2018 invoice from the law firm shows Hunter spent a total $68,933.41 on the ‘restructuring’ beginning in September 2016.

The same year Joe took on these bills from Hunter, he promised that ‘No one in my family will have an office in the White House, will sit in on meetings as if they are a cabinet member, will, in fact, have any business relationship with anyone that relates to a foreign corporation or a foreign country.’

Yet not only did Hunter hold on to his 10% share of BHR through 2021, confirmed by White House press secretary Jen Psaki last February, the emails also indicate Joe knew about it, and even agreed to pay Hunter’s legal fees for the firm.

The bills also include $412,309.23 in unpaid taxes dating back to 2015.

The New York Times reported earlier this month that Hunter had taken out a million-dollar loan to pay his delinquent tax bill in an apparent effort to stave off an alleged tax fraud prosecution.

Wisconsin Republican Senator Ron Johnson, who along with Senator Chuck Grassley is investigating Hunter’s foreign business deals, said Joe Biden’s unaccounted-for millions are ‘another disturbing piece of information that raises questions that deserve answers.’

‘When will the corporate media start doing their job and ask President Biden these questions?’ he said. ‘And when will President Biden start being honest with the public? The American people deserve the truth.’

Iowa Republican Grassley told DailyMail.com: ‘Evidence of the president’s financial and business connections to Hunter continues to grow. It’s imperative for the first family to show the American people the transparency that they deserve.’

The president’s son is under federal investigation for tax offenses, money laundering and illegal lobbying for foreign clients.

Joe’s financial transparency disclosures show that he had more than enough money to foot Hunter’s burgeoning bills.

While in office Joe had a relatively modest income, but he enjoyed a flood of millions of dollars soon after he left office, much of which came from his memoir book deal and eye-watering speaking fees.

Between 2017 and 2019 he and First Lady Jill Biden reported $16.5million in gross income on their federal tax returns, released by the Biden campaign.

The vast majority came from their two companies, CelticCapri Corp and Giacoppa Corp, which they use for speaking and writing engagements.

But in Office of Government Ethics (OGE) fillings for the same period, Joe only reported $9.6million in income for himself and his wife.

Some of the remaining roughly $7million came from wages earned by the First Lady from her Northern Virginia Community College teaching job and a salary she paid herself from Giacoppa, which the couple were not required to report to the OGE.

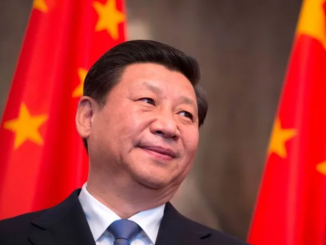

Hunter’s former business partner Tony Bobulinski claimed he met with Joe Biden to discuss a business deal with the Chinese

But a comparison of the income reported by Joe from his CelticCapri company on OGE reports versus what he told the IRS, shows a difference of almost $5.2million which remains unaccounted for.

No conclusive evidence has yet emerged that Joe profited from any of Hunter’s business deals.

But the potential discrepancy in the president’s financial filings, and his alleged links to Hunter’s Chinese ventures, raise troubling questions over where the unexplained $5,180,071 came from.

Joe’s OGE filing submitted in July 2019 shows around $8,699,787 of income for him and Jill from 2017 through May 2019. This includes $7,451,727 which he said came from CelticCapri Corp.

His OGE form submitted in May 2020 added another $907,160 that wasn’t paid until after their 2019 report, bringing the total for the period to $9,606,947, and the total for CelticCapri to $8,065,464.

Joe’s 2017 federal tax return shows $11million of adjusted gross income, almost $4.6million in 2018, and $985,233 in 2019. That’s a total of about $16.5million – some $6,990,032 more than what was listed on his OGE forms.

Joe’s tax returns detail income from CelticCapri of $9,636,690 in 2017, $3,030,667 in 2018 and $578,178 in 2019, making a total of $13,245,535.

This is $5,180,071 more than the CelticCapri earnings he reported on his OGE forms.

The OGE forms do not give precise figures for many of the couple’s assets, only rough value ranges.

But according to Joe’s form for 2015 while he was vice president, he and Jill reported assets worth between $317,028 and $1,080,000. By July 2019, the couple had assets worth between $2,237,033 and $7,955,000.

The figures show an increase in assets of at least $1,157,033 – and could be as much as $7,637,972.

It is clear from the president’s tax returns that his income largely came through his firm, CelticCapri Corp. Some of it is itemized on his OGE forms as being earned from speaking engagements and a book deal for his memoir, Promise Me, Dad. But where the remaining $5.2million money came from remains a mystery.

In a now-infamous email sent by Hunter’s business partner James Gilliar in May 2017, it was suggested 10% of the equity in their joint venture with Chinese oil giant CEFC would be ‘held by H for the big guy’.

Another partner in the deal, Tony Bobulinski, has claimed that the message meant Hunter would secretly hold the shares for his father, who was involved in the deal.

Several other emails on Hunter’s laptop refer to Joe as ‘the big guy’.

A report by Grassley and Johnson in September 2020 uncovered $5million in wire transfers from Hunter’s Chinese partners to a company controlled by the president’s son.

One of the CEFC executives, Patrick Ho, also paid Hunter a $1million retainer to represent him over a Department of Justice bribery prosecution.

In an audio-recorded conversation stored on Hunter’s laptop, the president’s son referred to Ho as the ‘f***ing spy chief of China’.

Ho did indeed appear to have ties to Chinese intelligence agencies, as he was the subject of a Foreign Intelligence Surveillance Act (FISA) warrant aimed at investigating potential foreign spies.

But Hunter’s claim that Ho was the ‘spy chief of China’ – or a senior Chinese intelligence officer – has not been proven.

* story by dailymail.co.uk