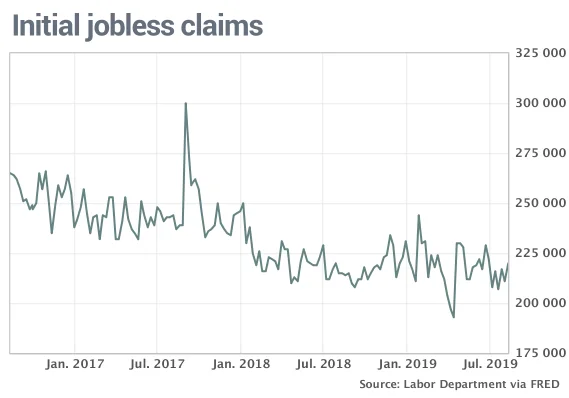

The number of people who applied for jobless benefits in early August climbed to a six-week high of 220,000, though the level of U.S. layoffs remains near a post 2008 recession low. Most of the increase appeared to occur in California.

By Jeffry Bartash, MarketWatch

Level of U.S. layoffs remain low, but rise in claims bears watching

The numbers: The number of people who applied for jobless benefits in early August climbed to a six-week high of 220,000, though the level of layoffs remains near a post 2008 recession low.

Initial jobless claims, a rough way to measure layoffs, rose by 9,000 to 220,000 in the seven days ended Aug. 10, the government said Thursday. That’s the highest level since late June, though most of the increase appears to have occurred in California.

Economists polled by MarketWatch estimated new claims would total a seasonally adjusted 213,000.

What happened: Raw or unadjusted jobless claims surged by almost 6,000 in California, but were they were little changed in every other state.

The more stable monthly average of new claims, meanwhile, rose by a smaller 1,000 to 213,750. The four-week average usually gives a more accurate read into labor-market conditions than the more volatile weekly number. It’s historically low as well.

The number of people in the U.S. already collecting unemployment benefits, known as continuing claims, increased by 39,000 to 1.73 million. That’s the highest level since March.

Big picture: The economy is not growing as fast as it was last year and businesses are anxious about the festering trade dispute with China, but very few companies have resorted to widespread layoffs. The labor market is still quite robust and that’s helping to keep the economy on an even keel even as the threats mount to a record expansion now in its 11th year.

What would worry economists is if claims start to ratchet higher, but there’s probably little reason to worry until claims move above 230,000 and head toward 250,000.

What they are saying?: “Jobless claims were a bit higher, but still very low by historical standards.,” said chief economist Scott Brown of Raymond James.

“This increase is unlikely to mark the start of a sustained deterioration,” said Ian Shepherdson, chief economist at Pantheon Macroeconomics.

Market reaction: The Dow Jones Industrial Average and the S&P 500 index rose slightly in Thursday trades, a day after the Dow lost 800 points. Stocks have been battered this month from an intensifying U.S. trade dispute with China that appears to have weakened the global economy.

The 10-year Treasury yield slipped to 1.57%, a low number that reflects broader worries about the economy.

*story by Market Watch News