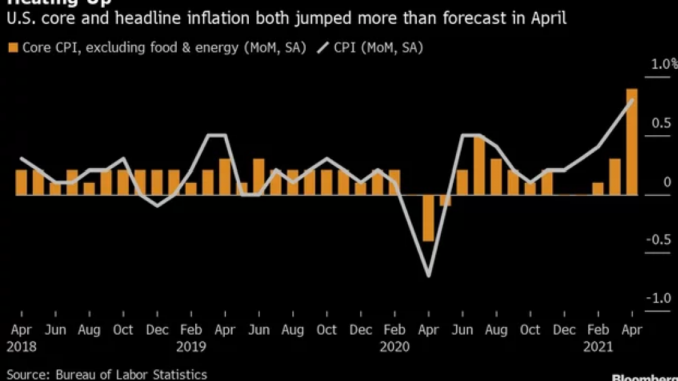

(Bloomberg) — U.S. consumer prices climbed in April by the most since 2009, intensifying the debate about the trajectory of inflation.

The consumer price index increased 0.8% from the prior month, amid a record increase in used-car costs as burgeoning demand gives companies latitude to pass on higher costs.

Excluding the volatile food and energy components, the so-called core CPI rose 0.9% from March, according to Labor Department data Wednesday. The surge in the core measure was broad-based and the largest since 1982.

The median forecasts in a Bloomberg survey of economists called for a 0.2% in the CPI and a 0.3% gain in the core measure. Treasuries tumbled following the data, with the 10-year yield rising to 1.647%, while the dollar climbed and S&P 500 futures extended losses.

The annual CPI figure surged to 4.2%, distorted by the comparison to the pandemic-depressed index in April 2020. This phenomenon — known as the base effect — will skew the May figure as well, likely muddling the ongoing inflation debate.

While Federal Reserve officials and economists acknowledge the temporary boost, it’s unclear whether a more durable pickup in inflationary pressures is underway against a backdrop of soaring commodities costs, trillions of dollars in government economic stimulus and incipient signs of higher labor costs.

The core CPI measure, which was also biased higher by the base effect, rose 3% from 12 months ago. For the last year the annual core inflation metric has held below 2%.

Wednesday’s report offers insight into bubbling price pressures across parts of the economy. Wages have shown signs of picking up, and supply chain challenges have elongated delivery times and driven materials prices higher.

While challenging for producers, swelling consumer demand has also given firms more confidence that they will be able to pass along some of the new costs. If sustained, the production bottlenecks could pose a risk of an acceleration in consumer inflation.

Fed Chair Jerome Powell has said the upward pressure on prices from the rebound in spending and supply bottlenecks will have only a “transitory” impact on inflation, but many disagree. Bond market expectations for the pace of consumer price inflation over the next five years surged earlier this week to its highest level since 2006.

The Labor Department’s data showed a 10% surge in the cost of used vehicles that accounted for more than a third of the increase in the overall CPI. New-vehicle prices also picked up.

*story by Bloomberg