President Joe Biden is emphasizing a tax code change targeting energy companies that would fund part of his American Families Plan and make gas prices rise.

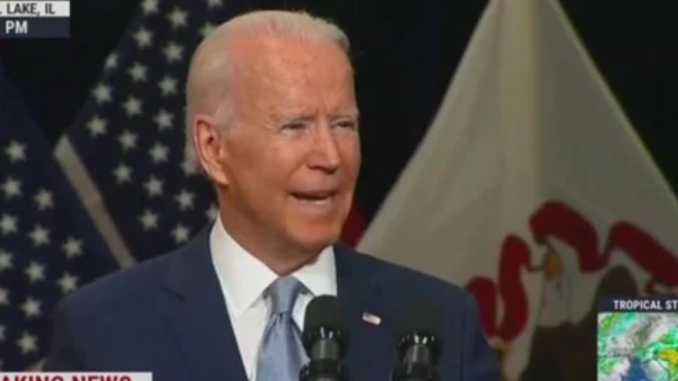

“If we end tax breaks for fossil fuels and make polluters pay to clean up the messes they have made, that would raise $90 billion. I’m not asking them to do anything that is unfair. Just not going to subsidize them anymore,” Biden told a crowd in Crystal Lake, Illinois on Wednesday. Press Secretary Jen Psaki had touted the speech as promoting provisions of the American Jobs Plan and American Families Plan that congressional Democrats will attempt to pass via the reconciliation process.

Biden appeared to be referencing a series of provisions in his $6 billion budget proposal for 2022. One provision, the intangible drilling cost deduction, would require oil and gas companies to pay more taxes on wells. Another, the Superfund excise tax, adds a tax to every barrel of crude oil that companies produce, in order to fund cleanups of Superfund sites.

Energy companies slammed the proposals when Biden introduced them.

“Increased taxes on American energy will only undermine economic recovery and job creation, push natural gas and oil investments overseas and lead to less government revenue, not more,” American Petroleum Institute President and CEO Mike Sommers told The Hill in May.

The national average of gas prices reached $3.13 per gallon over the Fourth of July holiday weekend, the highest since 2014. The Biden administration has attempted to downplay the costs, with Press Secretary Jen Psaki claiming in May that Americans “are paying less in real terms for gas than they have on average over the last 15 years—and they’re paying about the same as they did in May 2018 and May 2019.”

Economists cite multiple factors for the rising prices. They note increasing demand as Americans resume travel following the end of the COVID-19 pandemic, decreased refinery utilization, and overall inflation.

*story by The Daily Caller