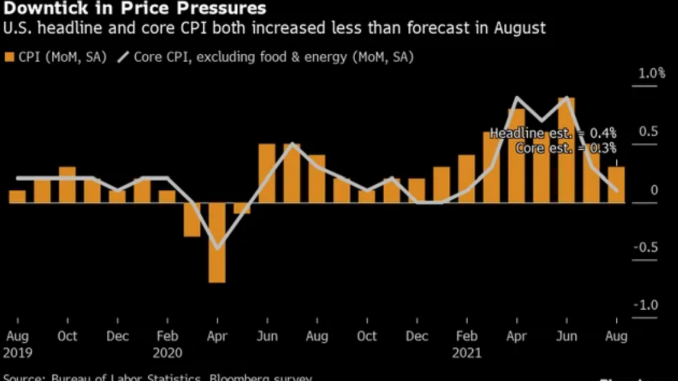

Prices paid by U.S. consumers rose in August by less than forecast, snapping a string of outsized gains and suggesting that some of the upward pressure on inflation is beginning to wane.

The consumer price index increased 0.3% from July, the smallest advance in seven months, according to Labor Department data released Tuesday. Compared with a year ago, the CPI rose 5.3%.

Excluding the volatile food and energy components, so-called core inflation climbed 0.1% from the prior month, the smallest gain since February and a reflection of declines in the prices of used cars, airfares and auto insurance.

Follow the reaction in real-time here on Bloomberg’s TOPLive blog

Economists in a Bloomberg survey called for a 0.4% increase in the overall CPI from the prior month and a 5.3% gain from a year earlier, based on the median estimates.

Treasuries pared declines following the data, while the dollar fell and S&P 500 futures rose.

Faced with mounting cost pressures as a result of materials shortages, transportation bottlenecks and hiring difficulties, businesses have been boosting prices for consumer goods and services. While price spikes associated with the economy’s reopening are beginning to abate, tenuous supply chains could linger well into 2022 and keep inflation elevated.

A Federal Reserve Bank of New York survey showed Monday that consumers expect inflation at 4% over the next three years, the highest in data back to mid-2013.

The CPI data precede next week’s Federal Open Market Committee meeting, where Fed officials will debate how and when to begin tapering asset purchases. Fed Chair Jerome Powell said last month that the central bank could begin reducing its monthly bond purchases this year, but didn’t give a specific time line.

Transitory Debate

The figures offer some validation of views among Fed officials and the Biden administration that high inflation will prove temporary. The report could also help blunt criticism from Republicans that President Joe Biden’s economic stimulus is spurring damaging inflation as he seeks to sell a $3.5 trillion long-term tax-and-spending package that’s also running into opposition from moderate Democrats.

Parts shortages that have driven up input costs are restraining production. In the last week, Toyota Motor Corp. and 3M Co. both downgraded their outlooks for car output due to semiconductor shortages, while Nestle said it is introducing even bigger price hikes as commodity and transportation costs surge.

Meantime, Hurricane Ida halted operations at refineries and petrochemical plants in the south, adding to pandemic-related supply chain bottlenecks and likely price pressures as well.

The CPI report showed prices for airfares dropped 9.1% in August, used cars were down 1.5% and vehicle insurance costs decreased 2.8%.

The costs of hotel stays and car rentals also fell, a sign that softening demand as a result of the more contagious delta variant is leading to a deceleration in prices in high-contact sectors most impacted by the pandemic.

Rents climbed 0.3%, the most since March 2020. Owners’ equivalent rent also rose 0.3%.

*story by Bloomberg