NEWS AND ANALYSIS:

China is making clear preparations for a war against Taiwan in the coming months, according to a conservative financial analyst.

J. Kyle Bass, a hedge fund manager and board member at the Hudson Institute’s China Center, said in a speech Wednesday that the key to preventing a conflict is for the U.S. government to prepare severe financial sanctions on Beijing.

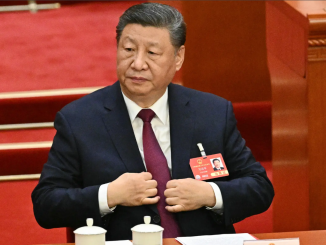

“I think it’s highly likely he invades Taiwan,” Mr. Bass said, speaking of Chinese President Xi Jinping.

“I’m not a military strategist or analyst. I’m a financial analyst,” he said in remarks to the China Center. “Looking at all the writing on what I call the great wall, it sure looks like it’s headed in one direction.”

The indicators are such that an attack on the island democracy, which would likely involve U.S. intervention and a wider regional war, could come in the next 12 to 18 months, said Mr. Bass, founder and chief investment officer of Hayman Capital Management.

Mr. Bass’ assessment contrasts with the views of Defense Secretary Lloyd Austin, Gen. Mark Milley, chairman of the Joint Chiefs of Staff, and other Biden administration officials, who argue that a Chinese strike on Taiwan is neither imminent nor inevitable.

Adm. John Aquilino, commander of the U.S. Indo-Pacific Command, however, has warned that Mr. Xi has ordered his troops to be ready for war over Taiwan by 2027.

CIA Director William Burns also said last year that a Chinese attempt to take over Taiwan is coming. He said that such an action is “less the question of whether the Chinese leadership might choose some years down the road to use force to control Taiwan, but how and when they would do it.”

In his speech, Mr. Bass said that Mr. Xi has made clear since last October that taking over Taiwan is a high priority.

Six major speeches by Mr. Xi have all urged the need to prepare for war and for the more than 90 million members of the ruling Chinese Communist Party to be ready for a “great struggle.” The key indicators of Chinese war preparations include People’s Liberation Army readiness simulations; political measures for war, including party directives and new laws; and a series of financial measures.

China has taken steps in recent months to insulate its dollar holdings from crippling U.S. sanctions like those imposed on Russia after its invasion of Ukraine.

“U.S. capital markets are the deepest, most liquid markets in the world and also currently have the highest interest rates in the developed world, China would be expected to be buying U.S. Treasury bills and bonds with said surpluses,” Mr. Bass said. “Instead, they have been selling.”

Mr. Xi also recently took steps to cut off data from the West, including large amounts of economic information, something Mr. Bass said is a key sign that China is girding for war.

China is also intentionally defaulting on dollar-denominated bonds, with an estimated 65% of China’s property developers’ $170 billion in bond holdings already in default.

Chinese security forces recently raided the offices of three U.S. companies — the Mintz Group, Bain Capital and Capvision — who were allegedly gathering data on Chinese economic competitors. The raids were carried out under a new espionage law that makes such data collection illegal.

Beijing is also diversifying away from dollars to gold, announcing in April that it raised its holdings of gold by 8.09 tons to a current stockpile of 2,076 tons. Grain also is being stockpiled in anticipation of a coming conflict, Mr. Bass added.

The U.S. investor said China can be deterred from war if the United States were to impose crippling financial and economic sanctions.

“What I’m advocating for is — if 86% of cross-border settlement for all of China’s daily transactions are in dollars, we could hobble their economy if we press one button,” he said.

Cutting off China from the international financial transaction clearing system, known as SWIFT, would devastate Beijing’s export-oriented economy, he argued. China should be put on notice that if there is an invasion of Taiwan, all Chinese state-owned enterprises and banks will be blocked from SWIFT, he said, bringing the domestic economy to a halt within a month.

The idea has been opposed by Wall Street financial interests that have prevented successive administrations from considering the action, Mr. Bass said. Using SWIFT as a deterrent to China is viewed as “too incendiary” by those who want to make money in China, he added.

The Treasury Department and its Office of Foreign Assets Controls should be readying such action, Mr. Bass said.

Treasury Secretary Yellen on China visit

Treasury Secretary Janet Yellen said her recent visit to China sought to stabilize U.S. relations with China but indicated the results may have been less than successful.

“Deepening communication, pursuing a healthy economic competition and cooperating on shared global challenges will help us accomplish that,” Ms. Yellen said of the stabilization bid in a tweet.

Critics of increased engagement with Beijing hit Ms. Yellen for the optics of her meeting with Chinese Vice Premier He Lifeng. She was shown on video bowing awkwardly three times with no reciprocation from Mr. He.

The protocol error was viewed as a sign of American weakness in dealings with the Chinese government.

Ms. Yellen was not asked about the bows at a news conference in Beijing, or two subsequent news interviews. She did make a point of saying at the press conference that neither she nor President Biden views U.S.-China relations through the prism of great power conflict.

“We believe that the world is big enough for both of our countries to thrive,” she said. “Both nations have an obligation to responsibly manage this relationship: to find a way to live together and share in global prosperity.”

The secretary said the Biden administration wants “healthy competition” with China and is opposed to “decoupling” economically. But the administration is determined to secure critical supply chains and will not hesitate to impose “targeted national security actions,” she added.

The administration is also preparing to restrict U.S. corporate investments in China, Ms. Yellen said in an interview with CBS News. In another broadcast interview, Ms. Yellen declined to say specifically that her visit was a success in bolstering relations with Beijing.

“I think it’s certainly been constructive and helped,” she told NPR, lamenting that Washington and Beijing have “grown apart and misunderstandings have developed.”

The Yellen visit followed an earlier trip to Beijing last month by Secretary of State Antony Blinken and the State Department announced that John Kerry, the administration’s climate envoy, will visit China next week.

The visits by three senior officials are part of a new policy of seeking a detente with China.

Microsoft reveals Chinese email hack…

The software giant Microsoft this week disclosed that Chinese hackers gain access to government email accounts in a bid to obtain intelligence on the United States. The company said in a statement on its website that it had mitigated an attack by a China-based hacking group called Storm-0558.

“Storm-0558 primarily targets government agencies in Western Europe and focuses on espionage, data theft, and credential access,” the statement.

Beginning in June, about 25 organizations including government agencies and private companies were hit by the cyberattacks.

The hackers were linked to the Chinese government and used forged authentication tokens to access user email from a Microsoft account, the company said.

A White House spokesman told reporters that no classified networks were breached in the attacks.

The sophistication of the operations and the targeted intrusions, however, suggest the Chinese hacking group was part of China’s Ministry of State Security, which conducts aggressive cyberattacks, or working for the agency.

“We assess this adversary is focused on espionage, such as gaining access to email systems for intelligence collection,” said Charlie Bell, a Microsoft executive vice president, in a blog post on Tuesday night.

Article From: The Washington Times