(Bloomberg) — Faith in the world-conquering, relentless, sure-thing America First trade is fraying on bets world markets will turn the corner in 2020.

Risky assets outside the U.S. are seeing fresh flows as optimism over a trade deal buoys expectations for global growth. Stocks in Europe just took in money for a fourth straight week and emerging markets notched the strongest buying in 41 weeks, according to a Bank of America Corp. report citing EPFR Global data.

Meanwhile, U.S. equities saw outflows over the same period, with a similar phenomenon surfacing in credit. Strategists have long warned on the dangers of overweighting U.S. risk assets, citing leveraged balance sheets and the aging business cycle. But even with the bull market continuously defying the naysayers, conviction is growing on Wall Street that a rotation is afoot.

“Our preference for non-U.S. over U.S. equities is greater than before,” Morgan Stanley strategist Andrew Sheets wrote in a note on Sunday. “Relative to past mid-cycle slowdowns, for example, U.S. equity markets are significantly more expensive, U.S. credit spreads are tighter and volatility is lower. In contrast, global equity valuations are in line with their average during past inflections of mid-cycle growth.”

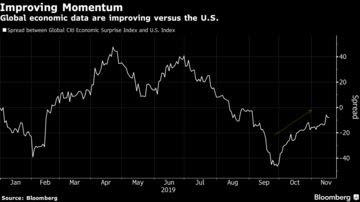

Tailwinds for the rest of the world are multiplying. The world’s two economic superpowers are edging closer to a phase-one trade deal that will likely put a temporary end to tariffs. U.S. economic data are deteriorating faster relative to the world. And the revival in cyclical and volatile shares also points to improving risk appetite that should benefit stocks beyond America, especially emerging markets.

This year’s near-relentless rally of American shares and credit versus the rest of the world was looking shaky late summer, with the greenback subsiding from a two-year high and easing financial conditions across the world.

Indeed, the global catch-up trade has been on the up since late August, when pessimism over the global economy waned. But sentiment has whipsawed. Last week, an exchange-traded fund tracking the S&P 500 bested a basket of non-U.S. equities by the most since July 26, which was an intermediate peak for the American benchmark.

But the valuation case looks compelling. The S&P 500 is 28% pricier than the rest of the world, compared with a 10-year average of 18%. Regions like Europe, which has seen equity outflows of nearly $100 billion this year, are especially under-owned by investors.

Traders are taking notice of the discount along with the brightening trade outlook. ETFs targeting non-U.S. equities have drawn $1.9 billion of inflows in the past week, compared with just $146 million for American shares, data compiled by Bloomberg show.

Even in the bond market, demand is growing for debt in Europe and developing economies. In a sign of stronger risk appetite, emerging-market local-currency bond funds lured $3 billion over the past three weeks, the most since January 2018, according to Deutsche Bank. European corporate bond funds posted inflows last week, while U.S. credit funds saw redemptions.

Still, for the shift to endure, a fundamental improvement in the global economic backdrop is needed, according to Edmund Shing, global head of equity derivatives strategy at BNP Paribas SA in London.

“This would have to coincide with a continued cyclical value recovery on the back of recovering PMIs and a rebound in global capex spending,” he said. “These are nascent trends, but need to be confirmed moving forward.”

*story by Bloomberg