The world economy’s ability to recover from the coronavirus may ultimately depend on how soon businesses can repair damaged and broken supply chains.

Here’s what they’re up against. In the costs to move goods in airplanes, ships, trains and trucks, what you see is a global economy near suspended animation. With billions of people locked down and entire industries hibernating, the movement of anything but essential food or medical products has neither a push from the supply side nor much pull of demand.

Lee Klaskow, a senior analyst for logistics at Bloomberg Intelligence, says the virus means “chaos for supply chains.”

Below are seven charts that help illustrate what he’s talking about.

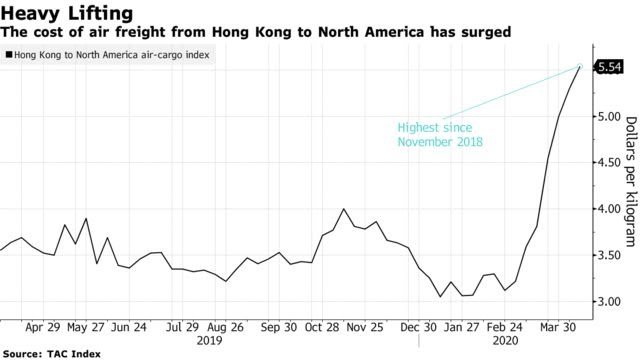

Air-freight rates are soaring after drastic cuts in passenger flights left airlines with less capacity for cargo, and demand rises for sending goods faster than a container ship can make the journey. The cost of air freight from Hong Kong to North America, which typically peaks around November as merchants stock up before the busy holiday shopping season, has jumped since the start of the year, TAC Index data show.

The surge in rates is true for all key routes, including the movement of goods by air from the European hub of Frankfurt to North America. In March, American Airlines announced cargo-only flights on grounded passenger jets between Dallas and Frankfurt to move medical supplies, mail for U.S. military personnel, telecom equipment and e-commerce packages. It was the airline’s first scheduled cargo-only flight since the last of its Boeing 747 freighters was retired in 1984.

It’s not just air cargo that’s pricier. The costs of commercial shipping — which accounts for about 80% of global trade — have also surged. Moving a 40-foot box to Shanghai from Rotterdam is now 58% pricier than the last quoted price in 2019. Curfews and lockdowns are hindering operations at ports, and straining the ability to replace seafarers on board ships.

The benchmark rate to move containers between the port hubs of Hong Kong and Los Angeles fell 5.1% this week from a year earlier, data from Drewry Shipping Consultants showed. This is despite liners raising prices and curtailing capacity with blank sailings, highlighting the severe demand headwinds brought on by the coronavirus pandemic as more retailers cancel or postpone orders, according to Klaskow.

The pandemic could cause a deeper collapse of international trade flows than at any point in the postwar era, the World Trade Organization said earlier this month, predicting that trade could shrink as much as 32% this year. As the above chart shows, the U.S. experienced a huge drop-off in the volume of exports in March.

From India to Europe and Africa, trucking goods has become more difficult because of border delays or closures aimed at containing the pandemic. In the U.S., demand for truck transportation initially spiked at the start of the pandemic as people stocks up pantries ahead of lockowns, but it’s now plummeted to the lowest since the start of 2017.

Recent surges in North American trucking demand “have given way to recessionary pressures which are being felt on rail volumes as well. We believe weakness will persist until economies are able to restart,” BI’s Klaskow says. Looking ahead, he says the “early signs that the freight economy is recovering will be increased demand for expedited modes like air freight or trucking.”

The narrative is similar in the freight-rail industry. In the U.S., the number of carloads dropped to the lowest since December 2017 in the week ended April 11 from a year earlier, according to the Association of American Railroads. Of the 10 commodity groups tracked by the association, nine fell. Coal carloads have dropped 19% so far this year, the most among all the commodities tracked.

*story by Bloomberg