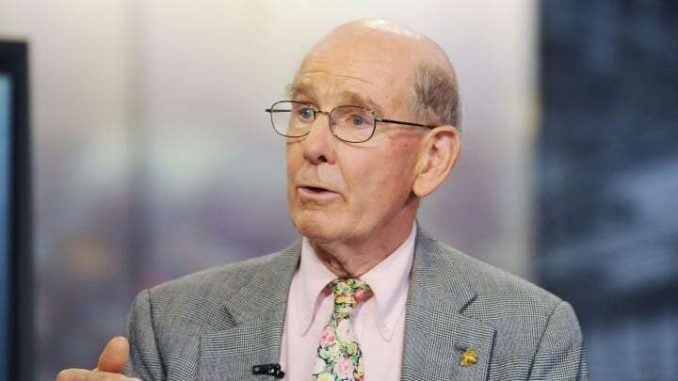

Stocks could be poised for a big drop similar to the market’s decline during the Great Depression, according to financial analyst Gary Shilling.

In a CNBC interview, Shilling said the stock market could plunge between 30-40% over the next year as investors realize the economic recovery from the coronavirus recession could take longer than expected.

“I think we’ve got a second leg down and that’s very much reminiscent of what happened in the 1930s where people appreciate the depth of this recession and the disruption and how long it’s going to take to recover,” he said.

The S&P 500 plunged in February and early March as the coronavirus pandemic spread across the U.S., forcing businesses to shut down and lay off workers. Since mid-March, the index has rebounded roughly 40% as investors have become optimistic about the gradual reopening of the economy and policymakers have injected trillions of dollars of economic stimulus into the financial system.

Early economic data has bolstered the case for a V-shaped recovery, where the economy bounces back quickly from a steep downturn, yet some investors are still cautious as the number of coronaviruses cases in the U.S. continues to rise. Many Americans have missed out on the recent market rally, with record-high levels of cash sitting on the sidelines.

Shilling said the S&P 500′s comeback resembles its rebound in 1929, when stocks rallied after an initial crash. He warned history could repeat itself with the S&P 500 poised to tumble again like it did in the early 1930s after the severity of the Great Depression became clear.

“Stocks are [behaving] very much like that rebound in 1929 where there is absolute conviction that the virus will be under control and that massive monetary and fiscal stimuli will reinvigorate the economy,” he said.

Shilling, who is the author of several books including “The Age of Deleveraging: Investment Strategies for a Decade of Slow Growth and Deflation,” said the coronavirus pandemic will force consumers to remain more cautious about spending in the coming years.

“I think we’re going to see downward pressure on prices and that works to the advantage of Treasury bonds, which have been my favorite since 1981,” he said.

*story by CNBC